POLA

POLA 2024 Information

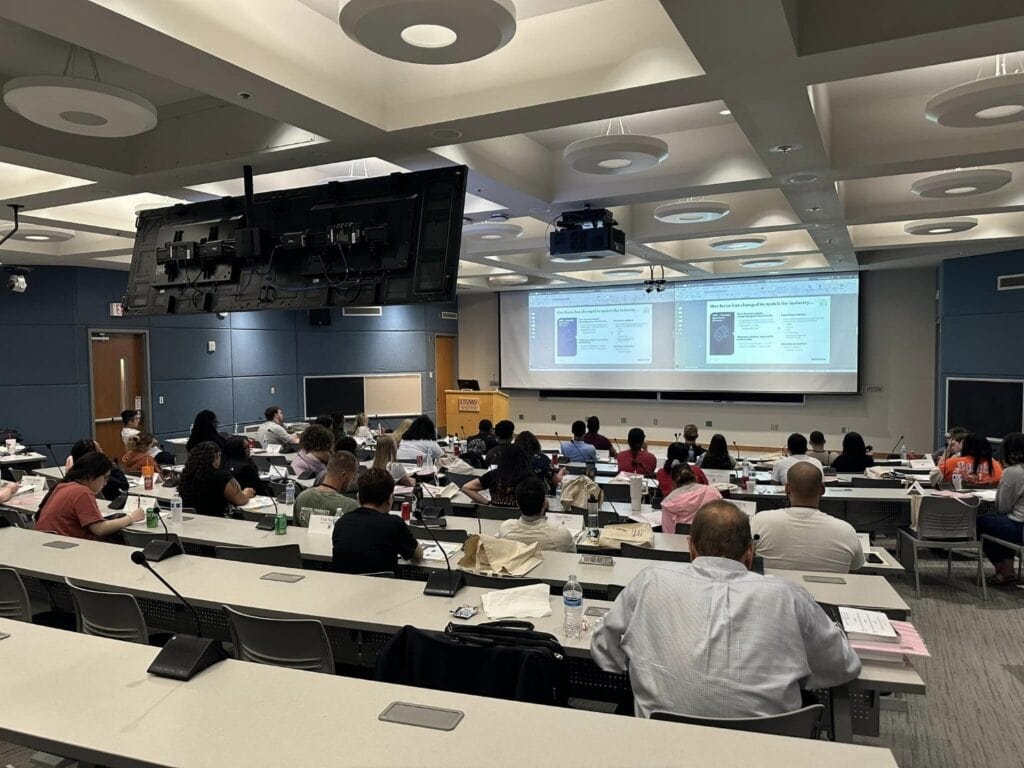

The University of Arkansas for Medical Sciences (UAMS) will be hosting the upcoming session of POLA from June 24-28, 2024. POLA is open to students nationwide, but our maximum enrollment for this session is 40 students. The POLA curriculum is designed for current P2 students (rising P3s), but we encourage current P1 students to apply as well. P1 students at accelerated programs (three-year Pharm.D. schools/colleges) will be preferentially admitted over P1s from four-year schools/colleges. We received over 120 applicants for POLA 2023 and we expect high demand for POLA 2024. POLA 2024 will be an in-person event at the main UAMS campus in Little Rock, Arkansas.

We look forward to hosting you, Seth

What is POLA?

POLA is a week-long academy focused on the fundamentals of pharmacy ownership, leadership and self-awareness. The POLA curriculum is specifically designed to help prepare students and equip them with the tools they need to be successful independent pharmacy owners. All POLA attendees will prepare a team mini-business plan presentation utilizing best practices for competing in the NCPA Student Business Plan Competition. The college was proud to host 42 students for the 2023 event from 28 different institutions across the country.

Who Can Come?

POLA is open to student pharmacists nationwide. However, our maximum enrollment for POLA 2024 is 40 students. Contact your NCPA Chapter Advisor or Dean of Student Affairs about applying to POLA 2024. Applications are sent to all colleges in December/January each year.

When and where is POLA?

POLA is held on University of Arkansas for Medical Sciences campus in Little Rock, Arkansas.

The upcoming session will be June 24-28,2024

POLA Curriculum Highlights

- What it takes to own a pharmacy

- How to write a real-world business plan and best practices for submitting a business plan to the NCPA Business Plan Competition

- Personal and professional development

- Self-awareness

- Importance of leadership in the pharmacy profession

How much does it cost to attend POLA?

Registration and tuition for POLA are free. All student meals are provided (free) during the academy, but students are responsible for their travel to and from Little Rock along with housing during their 5-day stay. POLA lodging is at a nearby UAMS affiliated hotel and can range from $40 to $75 per night, depending on if you are willing to share a multi-occupancy room or suite with other POLA attendees. Students are welcome to stay in alternate lodging but will be responsible for travel to and from the UAMS campus each day.

*** Please consider talking with your Dean or NCPA Chapter Advisor to see if they are willing to provide you with a travel/housing stipend to attend POLA 2024.

POLA 2022 Day-to-Day Breakdown

Day 1: Our first day served as an introductory day for POLA. We focused on topics such as Emotional Intelligence, Leadership, Personal Finance, and obtained our Sparketypes. Lastly, we ended the day with our annual great debate held between the students.

Day 2: On the second day, the students got some fresh air at the Arkansas 4H Center. There they conducted several team-building exercises, worked together taking on the high ropes course, and finished the day challenging themselves on the 4H zipline.

Day 3: On our third day, the students learned how to generate a real-world business plan that you would submit to a lender. They were then immersed in information concerning financial documentation and current state of independent pharmacy ownership. We ended the night with our Ownership Social at Flying Saucer in downtown Little Rock.

Day 4: Thursday started with learning about best practices for competing in the NCPA Business Plan Competition and concluded with reviewing the NCPA Financials Digest. Then the student broke out into teams where they spent most of the day generating their business plan for the Friday presentation. The day concluded with the Owner Networking Dinner where local independent pharmacy owners shared their expertise and advice to our upcoming pharmacy owners.

Day 5: Friday morning the teams presented their business plans and fielded questions from POLA faculty and attendees.

Want to know more? Contact us!

Seth Heldenbrand, Pharm.D.

HeldenbrandSeth@uams.edu

501-686-6494

Associate Dean for Experiential Education, Associate Professor, Pharmacy Practice Department

UAMS College of Pharmacy

Schwanda Flowers, Pharm.D.

sflowers@ffb1.com

501-672-5040

Managing Director, PSD

First Financial Bank, Little Rock